35+ down payment required for mortgage

Web Using Your RRSP as a Down Payment Under the federal governments Home Buyers Plan first-time home buyers are eligible to use up to 35000 in RRSP savings per person 70000 for. The loan limit for a single-family home is 472030 in most counties.

Home Loan Downpayment Calculator

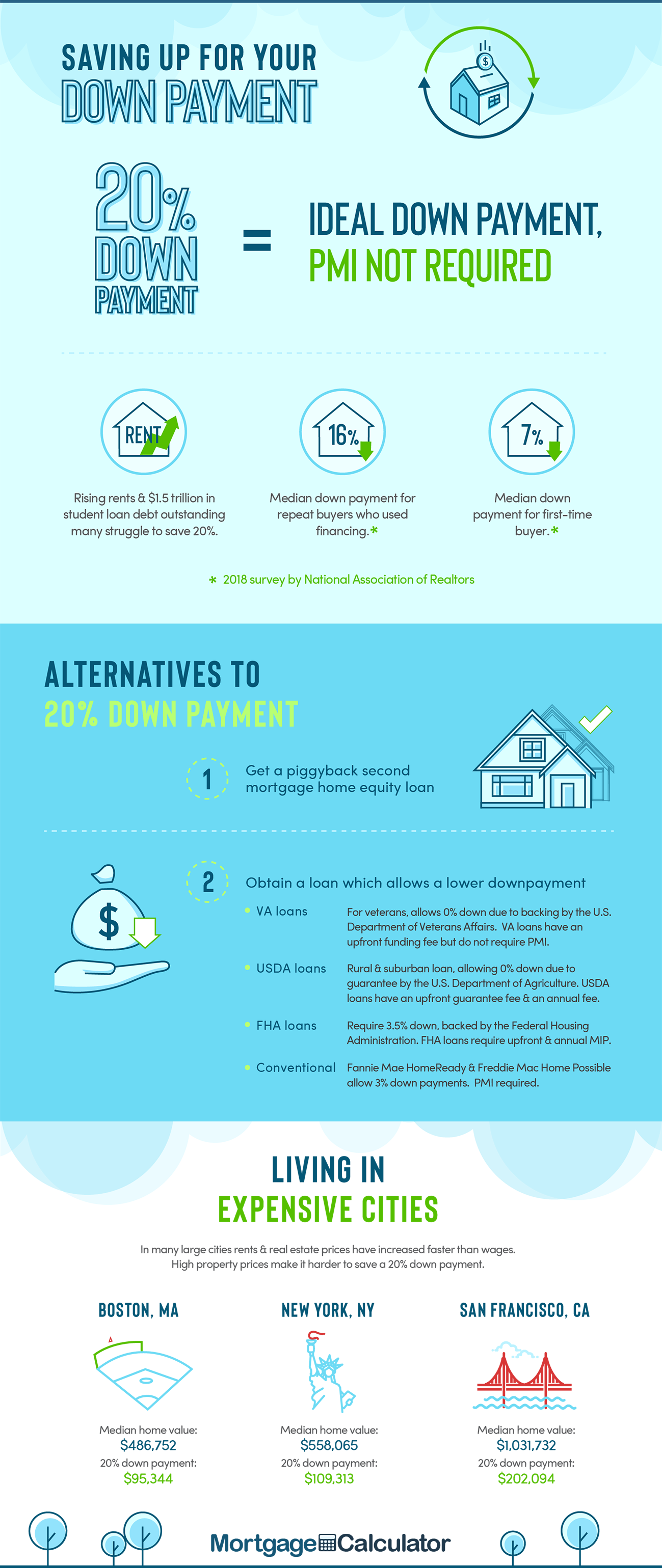

Web This strategy involves taking out two loansone for 80 of the homes purchase price the other for as much of the remainder as possible.

. Also you can buy a. Web Down payments are usually shown as a percentage of the price. If the purchase price is 200000 and you make a 40000 down payment your mortgage will be only 160000 giving you up to 20 equity off.

Some lenders may require a minimum down payment of 25 or even 30. Ad Best No Down Payment Mortgage Loans Of 2022 Compared Reviewed. If you have a credit score.

Web Down payment requirements. Web If you opt for an FHA loan which allows down payments as low as 35 youll be stuck paying an upfront mortgage insurance premium and an annual insurance premium. These can only be applied to fixed-rate mortgages.

Ad 5 Best House Loan Lenders Compared Reviewed. Compare Offers From Our Partners To Find One For You. A 10 down payment on a 350000 home would be 35000.

With a Low Down Payment Option You Could Buy Your Own Home. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web FHA loans require a down payment of 35 percent.

Web What percentage of the purchase price is required as a down payment for conventional conforming loans to avoid paying private mortgage insurance. Web The bank will base the loan amount on the 200000 figure because its the lower of the 2. Web Even though FHA loans dont have minimum or maximum income requirements they do have loan limits.

Compare the Best House Loans for February 2023. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web With a 20 down payment you can typically avoid paying for private mortgage insurance known as PMI.

Unlike conventional mortgages mortgage insurance includes both. Web As a general rule of thumb you can expect to make a down payment of at least 10 on your jumbo loan. Compare the Best House Loans for February 2023.

If you are taking out a VA loan for the first. With a Low Down Payment Option You Could Buy Your Own Home. View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

Ad Tired of Renting. You have 40000 for a down payment so you need a 160000 loan to meet the 200000. Web An FHA loan is ideal for first-time buyers with less-than-perfect credit scores and offers down payments as low as 35.

Web This fee varies largely depending on the size of your down payment. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web FHA loans Backed by the Federal Housing Administration FHA an FHA loan requires only 35 percent down with a credit sore as low as 580.

Apply Get Pre-Approved Today. The larger your down payment the lower your VA funding fee. Ad 5 Best House Loan Lenders Compared Reviewed.

Borrowers of any income level and with FICO scores as low as 580 can qualify. Choose Smart Apply Easily Today. With a down payment less than 20 youll likely need to make.

Comparisons Trusted by 55000000. Its available to all qualified buyers regardless of income level. Comparisons Trusted by 55000000.

Web If you have a down payment of at least 35 of the purchase price you may still qualify for a mortgage without the confirmation of employment that is typically required. Web Home Possible Advantage requires a 3 down-payment but can allow up to 105 financing when combined with a second mortgage. Why Rent When You Could Own.

Web If your down payment is less than 20 of the price of your home you must purchase mortgage loan insurance. Web To help low-income buyers in the US the Department of Housing and Urban Development HUD requires all Federal Housing Administration FHA loans to provide insurance to primary. Prior to the subprime mortgage.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. If youre self-employed or have a poor credit history your lender may require a. Ad How Much Interest Can You Save By Increasing Your Mortgage Payment.

Apply Get Pre-Approved Today. Interested in Buying a Home with No Money Down. Web A Federal Housing Administration Mortgage has a minimum down payment of only 35.

When applying for a mortgage to buy a house the down. This is possible because the Federal. Log in for more.

Compare Offers From Our Partners To Find One For You.

How Much Should You Put Down On A House Not 20

Best Reverse Mortgage Services In Arizona Sun American

Down Payment Resource Releases Q4 2021 Homeownership Program Index Send2press Newswire

San Antonio Board Of Realtors Implements Down Payment Resource To Raise Realtor And Homebuyer Awareness Of Down Payment Assistance Programs Send2press Newswire

When You Might Need An Alternative Lender Mortgage Mortgage Rates Mortgage Broker News In Canada

Cmp 15 03 By Key Media Issuu

Introducing Our Essex Advantage 100 Fha Dpa Product 0 Down Payment In House Approval Welcome To Our Essex Advantage Program Fha 100 Down Payment Ppt Download

Create A Loan Amortization Schedule In Excel With Extra Payments

Down Payment Resource Releases Q1 2022 Homeownership Program Index Send2press Newswire

Free 35 Loan Agreement Forms In Pdf

Home Loan Downpayment Calculator

Daily Corona Virus Mortgage Updates Mortgage Broker Vancouver Bc Burnaby Bc Canada

The Bushman Team Academy Mortgage Home Facebook

Earnest Money Vs Down Payment What Is The Difference

Down Payment Calculator How Much Money Do You Need

Dominion Lending Centres Nexgen Mortgages Opening Hours 2840 Peatt Road Victoria Bc

Fha Down Payment Requirements For Homebuyers 3 5 Or 10